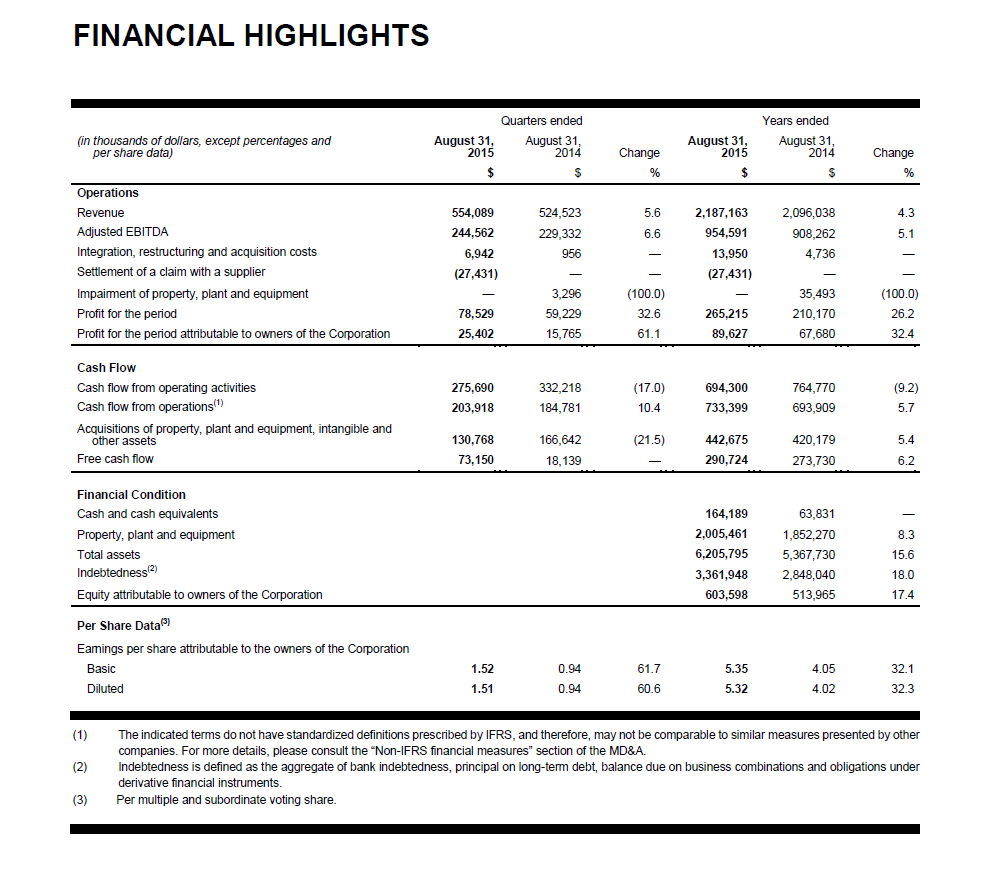

• Revenue for the fourth quarter increased by $29.6 million, or 5.6%, to reach $554.1 million

• Adjusted EBITDA(1) increased by $15.2 million, or 6.6%, to reach $244.6 million

• Free cash flow(1) increased by $55.0 million to reach $73.2 million

• Atlantic Broadband, a wholly-owned subsidiary of Cogeco Cable Inc., completed the acquisition of MetroCast Communications of Connecticut, LLC; and

• Cogeco Inc. increases its quarterly dividend from $0.255 to $0.295 representing a growth of 15.7%.

Montréal, October 28, 2015 – Today, COGECO Inc. (TSX: CGO) (“COGECO” or the “Corporation”) announced its financial results for the fourth quarter and fiscal year ended August 31, 2015, in accordance with International Financial Reporting Standards (“IFRS”).

For the fourth quarter ended August 31, 2015:

• Revenue increased by $29.6 million, or 5.6%, to reach $554.1 million mainly driven by growth in the Cable and Enterprise data services segment through the improvement of its American cable services and Enterprise data services operations, with stable revenue in its Canadian cable services operations combined with favorable foreign exchange rates compared to last year;

• Adjusted EBITDA increased by $15.2 million, or 6.6%, to reach $244.6 million compared to fiscal 2014 mainly from the improvement in the Cable and Enterprise data services segment, the favorable foreign exchange rates compared to the same period of last year as well as cost reduction initiatives in the radio broadcasting and out-of-home advertising business activities;

• Profit for the period amounted to $78.5 million of which $25.4 million, or $1.52 per share, is attributable to owners of the Corporation compared to profit for the period of $59.2 million for the same period in fiscal 2014 of which $15.8 million, or $0.94 per share, was attributable to the owners of the Corporation. The increase is mostly attributable to the improvement of adjusted EBITDA and the $27.4 million settlement of a claim with a supplier in the Cable and Enterprise data services segment, partly offset by increases in financial expense and income taxes;

• Free cash flow reached $73.2 million compared to $18.1 million, an increase of $55.0 million compared to the same quarter of the prior year. The increase is due to the improvement of adjusted EBITDA, the settlement of a claim with a supplier and the decrease in acquisitions of property, plant and equipment, partly offset by the increases in integration, restructuring and acquisition costs and current income taxes.

• Cash flow from operating activities reached $275.7 million compared to $332.2 million, a decrease of $56.5 million or 17.0%, compared to fiscal 2014 fourth quarter. The decrease is mostly attributable to changes in working capital combined with the increases in income taxes paid and integration, restructuring and acquisition costs, partly offset by the improvement in adjusted EBITDA and the settlement of a claim with a supplier;

• A quarterly eligible dividend of $0.255 per share was paid to the holders of subordinate and multiple voting shares, an increase of $0.035 per share, or 15.9%, compared to a dividend of $0.22 per share paid in the fourth quarter of fiscal 2014;

• On October 28, 2015, COGECO declared a quarterly eligible dividend of $0.295 per share, an increase of 15.7% compared to the $0.255 dividend per share paid in the fourth quarter of fiscal 2015;

• On October 27, 2015, the Corporation amended its Term Revolving Facility. Under the terms of the amendment, the maturity was extended by an additional year until February 1, 2021; and

• On August 20, 2015, Atlantic Broadband, a wholly-owned subsidiary of Cogeco Cable Inc., completed the acquisition of substantially all of the net assets of MetroCast Communications of Connecticut, LLC (“MetroCast Connecticut”), which served 27,256 video, 22,673 Internet and 7,817 telephony customers at August 31, 2015. The transaction, valued at US$200 million, subject to a post-closing net working capital adjustment, was financed through a combination of cash on hand, a draw-down on the existing Revolving Facility of US$90 million and US$100 million of borrowings under a new Term Loan A-2 Facility issued under the First Lien Credit Facilities. This acquisition enhances Cogeco Cable's footprint in the American cable market and provides for further growth potential.

For the fiscal year ended August 31, 2015:

• Revenue increased by $91.1 million, or 4.3% to reach $2.2 billion mainly driven by the growth in the Cable and Enterprise data services segment through the growth of its American cable services operations with stable revenue in its Canadian cable services operations combined with favorable foreign exchange rates compared to the prior year;

• Adjusted EBITDA increased by $46.3 million, or 5.1%, to reach $954.6 million compared to the prior year. The progression resulted mainly from the improvement in the Cable and Enterprise data services segment, the favorable foreign exchange rates compared to the same period of last year as well as cost reduction initiatives in the radio broadcasting and out-of-home advertising business activities;

• Profit for the year amounted to $265.2 million of which $89.6 million, or $5.35 per share, is attributable to owners of the Corporation compared to profit of the year of $210.2 million of which $67.7 million, or $4.05 per share, was attributable to the owners of the Corporation in fiscal 2014. The progression is mostly attributable to the improvement of the adjusted EBITDA, the settlement of a claim with a supplier in the Cable and Enterprise data services segment and last year's impairment of property, plant and equipment, partly offset by increases in integration, restructuring and acquisition costs, financial expense and income taxes;

• Free cash flow increased by $17.0 million to reach $290.7 million compared to $273.7 million in fiscal 2014 as a result of the improvement of adjusted EBITDA and the settlement of a claim with a supplier, partly offset by the increases in acquisitions of acquisitions of property, plant and equipment, integration, restructuring and acquisition costs, financial expense and current income taxes;

• Cash flow from operating activities reached $694.3 million compared to $764.8 million, a decrease of $70.5 million, or 9.2%, compared to the same period in fiscal 2014. The decrease is mainly attributable to the changes in working capital combined with the increases in financial expense paid and integration, restructuring and acquisition costs; partly offset by the improvement in adjusted EBITDA, the settlement of a claim with a supplier and the decrease in income taxes paid; and

• Dividends paid in fiscal 2015 totaled $1.02 per share compared to $0.88 per share in fiscal 2014.

(1) The indicated terms do not have standardized definitions prescribed by IFRS and, therefore, may not be comparable to similar measures presented by other companies. For more details, please consult the “Non-IFRS financial measures” section of the Management’s discussion and analysis (“MD&A”).

“We are satisfied with our financial results for the fourth quarter of fiscal 2015,” declared Louis Audet, President and Chief Executive Officer of COGECO Inc. “We have closed the year with results that are in line with expectations, demonstrating our capacity to grow, while maintaining rigorous cost control discipline.”

“We have been pleased with the results of Cogeco Cable’s subsidiary, Atlantic Broadband, and we are excited to continue our geographic expansion in the United States market with the acquisition of MetroCast Connecticut,” continued Mr. Audet. “In Cogeco Cable’s Enterprise data services segment, we have begun implementing the combination of our Cogeco Data Services and Peer 1 Hosting subsidiaries. I am very pleased to report that we can already see the benefits of this strategic decision through improved results. Once the process is complete, we can expect to continue building and strengthening our ability to attract, retain and grow a customer base that truly values the solutions and services we offer.”

“As for our Cogeco Diffusion subsidiary, we continue to maintain a strong position in the Québec radio market, enjoying a positive quarter thanks to solid audience ratings and tight cost management,” concluded Louis Audet.

Fiscal 2016 Financial Guidelines

COGECO revised its fiscal 2016 preliminary financial guidelines, as issued on July 14, 2015, to take into consideration the expected operating results from the acquisition of MetroCast Connecticut by Atlantic Broadband, the wholly-owned subsidiary of Cogeco Cable Inc., on August 20, 2015. Please consult the “Fiscal 2016 financial guidelines” section of the Corporation’s 2015 Annual Report for further details.

DETAILS ON FOURTH QUARTER RESULTS

ABOUT COGECO

COGECO Inc. (corpo.cogeco.com) is a diversified holding corporation which operates in the communications and media sectors. Through its Cogeco Cable Inc. subsidiary, COGECO provides its residential and business customers with video, Internet and telephony services through its two-way broadband fibre networks. Cogeco Cable Inc. operates in Canada under the Cogeco Cable Canada name in Québec and Ontario, and in the United States under the Atlantic Broadband name in western Pennsylvania, south Florida, Maryland/Delaware, South Carolina and eastern Connecticut. Through Cogeco Peer 1, Cogeco Cable Inc. provides its business customers with a suite of information technology services (colocation, network connectivity, managed hosting, cloud services and managed IT services), through its 21 data centres, extensive FastFiber NetworkTM and more than 50 points-of-presence in North America and Europe. Through its subsidiary Cogeco Diffusion, COGECO owns and

operates 13 radio stations across most of Québec with complementary radio formats serving a wide range of audiences as well as Cogeco News, its news agency. COGECO also operates Cogeco Métromédia, an out-of-home advertising company specialized in the public transit sector. COGECO’s subordinate voting shares are listed on the Toronto Stock Exchange (TSX: CGO). The subordinate voting shares of Cogeco Cable Inc. are also listed on the Toronto Stock Exchange (TSX: CCA).

- 30 -

|

Source:

|

COGECO Inc.

Patrice Ouimet

Senior Vice President and Chief Financial Officer

Tél. : 514-764-4700

|

|

Information:

|

Media

René Guimond

Vice-President, Public Affairs and Communications

Tél. : 514-764-4700

|

|

|

|

|

Analyst Conference Call:

|

Thursday, October 29, 2015 at 11:00 a.m. (Eastern Daylight Time)

Media representatives may attend as listeners only.

|

|

|

Please use the following dial-in number to have access to the conference call by dialing five minutes before the start of the conference:

|

|

|

Canada/United States Access Number: 1 800-505-9573

International Access Number: + 1 416-204-9498

Confirmation Code: 991781

|

|

|

By Internet at https://corpo.cogeco.com/cgo/en/investors/investor-relations/

|

|

|

A rebroadcast of the conference call will be available until November 4, 2015, by dialing:

|

|

|

Canada and United States access number: 1 888-203-1112

International access number: + 1 647-436-0148

Confirmation code: 991781

|